Back in 2010, 20-something-year-old me decided that I wanted to invest in Emerging Markets. I had just learnt about BRIC in university, and thought this was “the future”. So, as many young and ignorant first time investors might do, I went to consult my bank advisor. Of course, he was more than happy to sell me an emerging markets fund. So I went home happy.

Over the years, the fund’s performance was … frustrating. Basically, I watched the fund hover around its original value most of the time, and every once in a while I received a letter that it had paid some dividends. Not to me though! It reinvested the dividends instead.

Fast forward 10 years, and after reading many articles about managed funds vs index investing, it started to dawn on me that I had probably been sold a less-than-optimal-fund. It’s not that emerging markets weren’t growing, it’s that my fund had not been growing.

Performance Comparison

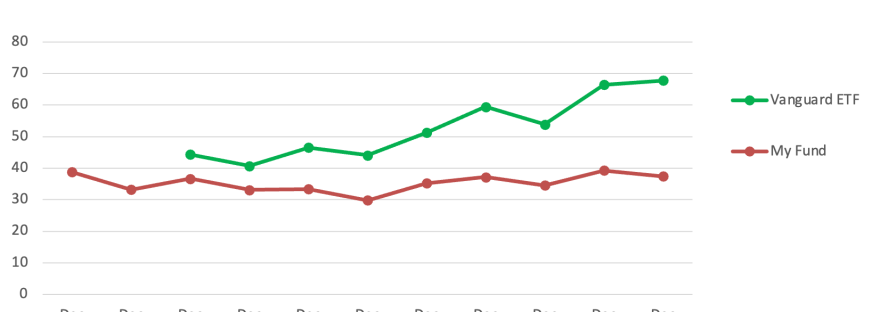

To illustrate my point, here is a full break-down of my actively managed fund’s performance over the years, compared to Vanguard’s Emerging Market ETF (IE00B3VVMM84). Vanguard’s fund is an index fund, meaning that it closely tracks the market development rather than trying to beat it. For the comparable time period of Dec 2012 – Dec 2020, my fund grew by 2%. Vanguard’s index fund on the other hand grew by 53% and that fund pays out the dividends instead of reinvesting. The difference is shocking!

But not only had the performance of my fund been sub-par, I had also been paying through the nose for the privilege. Here’s a full break-down of costs incurred over the holding time:

- Initial costs: 5% when buying (wowza!)

- Running costs: ca. 2% per year (yikes!)

Originally, I invested 3000€. My estimate given the costs above is that over the total holding time, I paid nearly 700€ in fees to the fund manager. And what did I get in return? At the end of 2020, my units were worth 2995€. So the fund manager made 700€, I lost 5€ (more when you consider inflation over 10 years), and I also lost out on significant gains I could have made if I had invested differently.

How much does Vanguard charge, you ask? Well… They charge 0.29% per year, with no initial costs — yep, that’s right. They charge only 15% of the annual costs compared to my fund, and yet they significantly outperformed it.

This was a painful realization for me. I’m glad that I only invested a comparably small amount. Of course, I finally sold this terribly underperforming fund. But in a way, I’m still glad that this happened.

I certainly learned some important lessons:

- Do your own research before investing, don’t rely only on your bank’s advice

- Before investing in anything, make sure to fully understand all the costs

- Understand the mechanics of your investment – are dividends paid out or reinvested?

- While some actively managed funds outperform the market, many don’t

- Index funds closely track the market, so your returns mirror the market developments

- When an asset consistently underperforms, don’t be shy to divest

Readers, have you ever made a bad investment? What happened, and what did you learn? Share your experiences in the comments!

6 thoughts on “Money Mistakes – My managed fund experience”